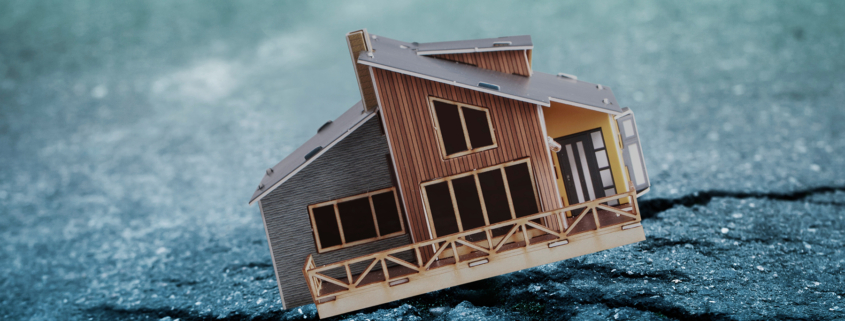

Earthquake Insurance for BC Homeowners – Is It Necessary?

Most home insurance policies do not include earthquake insurance. Is it something BC homeowners should consider?

There are regions in Canada, and certainly here in British Columbia, that are at greater risk of earthquakes. According to the Insurance Bureau of Canada, here in BC, there is a 30% chance that we will experience a significant earthquake event in the next 50 years.

Meantime, however, there are about 400 earthquakes recorded every year in BC. Approximately a dozen are felt by people, with many of the bigger events occurring offshore. The result, as many British Columbians know, is that these seismic events can leave costly destruction in their wake.

Earthquake insurance helps with expenses due to earthquake damage. These costs include home repairs, most often to the foundation and replacing damaged personal items. Earthquake coverage also covers living expenses incurred when homeowners must leave their homes during repairs and rebuilding.

Talk to your Working Ventures Insurance broker about whether earthquake insurance is right for you.

Is earthquake insurance really necessary in British Columbia?

As mentioned, earthquake insurance is not typically included in most homeowners’ coverage. But, it can be added if you believe your property is in an area of risk. Given the risk of earthquakes here in BC, it makes sense to consider it, particularly if you live in a region of the province that experiences these kinds of events.

In truth, earthquakes can occur just about anywhere. But some regions are at greater risk. The most vulnerable regions of the province and the country are:

- The BC coast and Lower Mainland

- Some areas in the Yukon

- Along the Ottawa and St. Lawrence Rivers, including the towns and cities on their banks – Quebec and Montreal, for instance

- The western shore of Lake Ontario and our Atlantic coast are at moderate risk for earthquakes

Curious about which regions of the province and country are most vulnerable to earthquakes? Check out the Government of Canada’s seismic hazard map of Canada.

What does earthquake insurance coverage offer?

When you add earthquake insurance coverage to your homeowners’ policy, it will be fundamental to your recovery in the event of a seismic event. If there’s a risk that your home will sustain damage, small or catastrophic, due to an earthquake, insurance will help you repair your home and help cover your living expenses while you are out of your home.

And while every policy is different, earthquake coverage includes three different types:

- Dwelling coverage. Covers the many costs associated with the repair or rebuild of your home.

- Personal property coverage. It will help to replace any damage to personal property, such as costly furnishings and electronics.

- Loss-of-use coverage. If you must leave your home due to damage from an earthquake, this will help cover any living expenses while your home gets repaired or rebuilt.

What amount of earthquake coverage do I need?

As with any other type of coverage, you should purchase enough insurance to cover the costs of replacing your home and any damaged contents within.

Working Ventures Insurance offers expert assistance to assess your need for earthquake insurance coverage. TALK TO US!